The Best Financial Aid Apps for Students

Navigating the realm of student finances can feel like an uphill battle. However, the right financial aid apps can transform your experience.

From intuitive budgeting tools to comprehensive student loan management, these applications are crafted to streamline your financial journey. They empower you to stay organized and make informed choices.

This article delves into the top 15 financial aid apps tailored specifically for students. Explore their standout features, robust security measures, and discover how they can aid you in budgeting, saving, and managing debt with ease and efficiency.

Contents

Key Takeaways:

Manage your finances easily with these top apps. Stay organized and never miss a financial opportunity!

1. Mint

Mint is a top-tier financial planning app that enables you to manage your budget with precision. This helps you make informed choices regarding college expenses, student loans, and funding options, ultimately leading to improved financial outcomes throughout your educational journey.

With its intuitive budgeting tools, you can set realistic spending limits and track your expenses in real-time. Mint s robust financial tracking features make it easy to monitor your income and outflows, helping you pinpoint areas where you can save.

Mint provides personalized advice tailored to your unique financial habits and goals. This allows you to make necessary adjustments along the way. The app connects seamlessly with numerous financial institutions, giving you a holistic view of your finances all in one convenient place.

2. You Need a Budget (YNAB)

You Need a Budget (YNAB) is an exceptional budgeting tool designed specifically for students. It offers expert support and personalized advice on financial aid options, including scholarships and grants.

This tool fosters a proactive budgeting mindset, enabling you to plan ahead instead of merely responding to bills as they arise. It simplifies the financial hurdles of college life into manageable segments, allowing you to set clear priorities.

YNAB encourages you to assign a role to every dollar, helping you understand where your funds are going and how they align with your educational aspirations. This structured approach not only assists in tracking essential expenses but also elevates your overall awareness of managing educational costs sustainably.

3. Acorns

Acorns is a financial planning app designed to make it easier for you to invest your spare change and save for college scholarships and other educational expenses.

With its unique round-up feature, the app rounds up your everyday purchases to the nearest dollar, investing that difference into a diversified portfolio. This streamlined approach allows you to grow your savings without even noticing the impact small amounts can add up significantly over time.

You ll find a range of investment options tailored to your individual risk tolerance and financial goals. This enables you to select an approach that truly aligns with your aspirations.

By integrating these simple saving habits into your routine, Acorns prepares you for college costs while fostering a lifelong commitment to financial responsibility and investment savvy.

4. Goodbudget

Goodbudget is the budgeting app designed to help you efficiently allocate your financial assistance, whether it comes from student loans or scholarships, to manage your college expenses effectively.

Using a visual approach, Goodbudget employs a system where you can create virtual ‘envelopes’ for various categories, such as tuition, textbooks, and living expenses. This method simplifies fund tracking and fosters mindful spending habits.

When you see exactly how much you have earmarked for each category, it encourages you to think critically about your financial choices. Over time, this method enables you to make informed decisions regarding your expenditures, allowing you to maintain control over your budget.

Ultimately, this alleviates the stress that often accompanies managing educational costs.

Take control of your financial journey download these apps today!

5. PocketGuard

PocketGuard transforms how you manage your finances as a student by clearly displaying your disposable income after factoring in college expenses and money you owe.

This innovative app takes it up a notch with powerful budgeting tools that let you categorize your spending and set financial goals that fit your unique lifestyle.

With real-time alerts, PocketGuard keeps you informed whenever you’re nearing your budget limits or making progress toward your savings goals. This ensures you’re always in control of your finances.

These features help you spend wisely and provide support in navigating the often daunting costs of higher education. This makes it easier for you to manage your funds and reduce financial stress.

6. Wally

Wally is your intuitive budgeting companion that enables you to track college expenses and manage financial aid. It ensures you remain in control of your finances throughout your educational journey.

With its user-friendly interface, this app turns the often overwhelming task of planning how you spend your money into a seamless experience, making it accessible even for those just starting their financial management journey.

The app’s tracking capabilities offer you a clear picture of your spending patterns. This allows you to quickly grasp where your money is going, equipping you to make informed decisions.

By pinpointing areas where you can cut back or save for future goals, Wally fosters a deeper understanding of your financial habits.

7. Clarity Money

Clarity Money is a budgeting app designed just for you. It offers a clear picture of your money situation and helps you find opportunities for saving and applying for scholarships, easing the burden of college costs.

With features like bill tracking and subscription management, this app helps you take control of your expenses. You can easily visualize recurring payments, eliminate unnecessary subscriptions, and streamline your budgeting process.

Armed with these tools, you can devise a financial strategy that prioritizes your educational expenses and maximizes your savings potential. The app categorizes your spending habits, allowing you to identify areas where you can cut back while boosting your financial literacy.

8. Prism

Prism is the budgeting app designed specifically for you, helping students like yourself manage bills and payments effortlessly while navigating college life.

By consolidating various bills into a single, user-friendly interface, it lets you view all your financial obligations at a glance. This streamlined approach simplifies the billing process, enabling you to plan your finances more effectively.

Automatic reminders help you avoid late fees and protect your credit score from potential pitfalls. As a result, you’re equipped to allocate your resources wisely.

This allows you to make informed decisions that enhance your financial literacy and stability throughout your academic journey.

9. Digit

Digit is the ultimate savings app that makes setting money aside a breeze! It’s designed to help students effortlessly save for college expenses no more tedious manual tracking.

With Digit, saving for tuition and other costs becomes a seamless experience. By intelligently analyzing your spending behavior, Digit adjusts the amount you save each week based on your habits.

This means saving feels like a breeze, not a burden. This sophisticated approach lets you focus on funding your education while automating the savings process.

Ultimately, Digit not only assists you in accumulating the resources you need but also cultivates a mindset that prioritizes education while managing your finances responsibly. It creates a balance that many students find invaluable.

Try out Digit today and take the stress out of saving for your future!

10. Qapital

Qapital utilizes goal-based saving techniques designed specifically for you. It helps you accumulate funds for college expenses while allowing you to customize your saving goals based on your educational needs.

With the user-friendly app, you can easily set up various savings targets, whether for tuition fees, textbooks, or living expenses.

The platform promotes thoughtful financial planning by enabling you to establish automatic transfers to your chosen goals. This seamlessly integrates saving into your daily routine.

You ll find insightful analytics within the app to track your progress, keeping you motivated and allowing for adjustments as needed.

By leveraging Qapital s innovative features, you not only enhance your saving capabilities but also develop essential skills that will significantly boost your overall financial literacy in the long run.

11. Loan Calculator Pro

Loan Calculator Pro is an essential tool for you to check your possible student loans. It helps you fully grasp the long-term effects on your college expenses.

With its intuitive interface, the app allows you to effortlessly input your loan amounts and terms. It immediately provides key information like monthly payment estimates, interest rates, and the total cost over time.

You can explore various loan scenarios, helping you assess the financial implications of your borrowing decisions. This encourages thoughtful decision-making and enables you to visualize how different amounts and repayment periods can impact your budget.

12. Scholly

Scholly is your go-to scholarship matching app, expertly connecting you with financial aid resources and college scholarships. It streamlines the application process to make it both efficient and accessible.

Utilizing a sophisticated algorithm (a set of rules for problem-solving), the app meticulously analyzes your profile taking into account your academic performance, interests, and background to recommend scholarships tailored specifically to your circumstances.

Completing your student profile is essential, as it allows the algorithm to pinpoint the most relevant opportunities for you. Stay vigilant about the various deadlines linked to different scholarships.

By staying organized and proactive in managing these timelines, you not only boost your chances of securing funding but also alleviate the stress often tied to financing your college education. Don’t miss out on these valuable scholarships start applying today!

13. Tuition.io

Tuition.io is your go-to platform for managing college costs and exploring a range of financial assistance options, from student loans to scholarships.

With intuitive tools at your disposal, you can effortlessly track your tuition payments, helping you stay organized and fully informed about your financial commitments.

You have the ability to compare various financial aid packages, ensuring you make choices that align with your unique financial situation.

This level of transparency aids in crafting a comprehensive funding strategy, granting you greater control over your educational financing. With these valuable resources right at your fingertips, you can devote more energy to your studies and worry less about how to cover your expenses.

14. My Student Loan Manager

Your Student Loan Manager offers you a comprehensive overview of your student loans, enabling you to manage repayment strategies while effectively budgeting for your college expenses.

This tool is crafted to simplify the often daunting task of grasping various loan terms and conditions. With features like loan tracking, you can maintain a vigilant eye on your balances and due dates, ensuring that no payment slips through the cracks.

The repayment calculators invite you to explore different payment plans, helping you identify the best option that aligns with your financial circumstances.

With personalized advice tailored specifically to you, you can make informed decisions about your loans, ultimately alleviating the burden of managing educational debt.

15. SALT

SALT is your go-to financial literacy platform, carefully designed to guide you through the confusing landscape of financial aid resources, scholarships, and budgeting for education affordability.

With an abundance of educational content designed specifically to enhance your financial literacy, SALT enables you to make informed choices about your student loans and expenses. The platform features interactive tools that simplify the management of scholarships and aid, allowing you to navigate your financial options effortlessly.

SALT also offers resources aimed at honing your personal finance skills, equipping you with the essential knowledge to budget effectively, save for the future, and grasp investment principles. This approach gets you ready to handle your financial responsibilities with confidence!

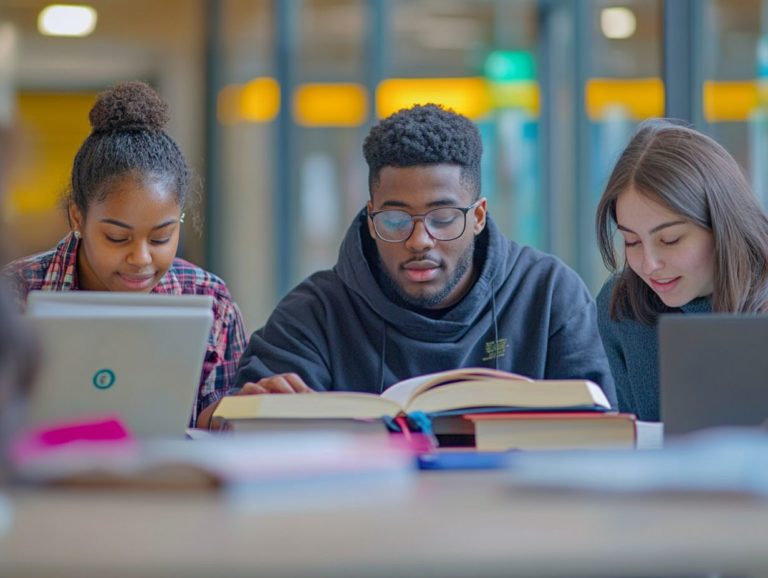

How Can These Apps Help Students with Financial Aid?

These apps play a crucial role in helping you navigate the world of financial aid, providing you with comprehensive tools to manage college expenses, apply for scholarships, and receive tailored advice on the funding options available to you.

Each app boasts unique features specifically designed to meet the needs of students like you as you maneuver through the complex world of higher education funding.

Some applications offer real-time tracking of scholarship opportunities, enabling you to swiftly identify and apply for awards that align with your profile. Others emphasize budget management, providing you with tools to keep an eye on your spending and set financial goals.

Certain platforms even offer personalized educational resources that break down every facet of the financial aid process, enabling you to make informed decisions about your financial future.

What Are the Key Features of Each App?

Each app presents distinct features tailored to address your diverse financial needs as a student, offering everything from budgeting tools to scholarship matching capabilities that enhance your financial planning.

By integrating expense tracking and income projections, these applications enable you to gain a clear overview of your financial situation. With their user-friendly interfaces, they simplify the management of your daily expenses and help you set achievable savings goals.

Many of these apps provide personalized recommendations for financial aid, ensuring you uncover funding opportunities that align with your unique educational journey. They often include helpful reminders for bill payments and deadlines for scholarship applications, promoting a more organized approach to your financial management.

Ultimately, such comprehensive features instill a sense of confidence as you navigate the complex monetary landscape of student life.

Are These Apps Secure to Use?

Security is a top priority when you re using financial apps, and you ll find that most of these platforms employ robust measures to protect your privacy and sensitive data.

These measures typically include advanced encryption protocols that keep your information secure during transactions and while it’s stored. Many apps also utilize multi-factor authentication, prompting you to verify your identity through several steps, which greatly minimizes the risk of unauthorized access.

Data protection policies are updated regularly to meet regulatory standards, ensuring that your financial and personal details are handled with the utmost care.

By familiarizing yourself with these security protocols, you can confidently manage your financial activities, secure in the knowledge that your information is well-protected against potential threats.

Can These Apps Help with Budgeting and Saving?

These apps are expertly crafted to enable you to budget and save effectively, helping you allocate your funds wisely toward college expenses and future financial aspirations.

With features like expense tracking and tailored financial goals, they offer you a comprehensive view of your spending habits.

One popular app allows you to categorize your expenses into essentials and luxuries, encouraging you to rethink those impulse buys. Another innovative tool introduces savings challenges, motivating you to set aside a specific amount each week, making it easier to build a financial cushion for emergencies or future investments.

Through timely reminders and progress tracking, these applications keep you accountable for your financial future, transforming financial literacy into an essential life skill.

How Can These Apps Help with Student Loans and Debt Management?

These apps offer valuable tools for managing student loans and debts. They help you navigate the complex world of loan repayment.

Features like loan tracking provide real-time updates on your balances and due dates. You can easily stay informed about your financial commitments.

Budgeting tools are key. They help you wisely allocate your funds to meet your payments on time.

You can ease the burden of student debt by using strategies such as:

- Applying for scholarships

- Exploring income-driven repayment options

- Understanding the advantages of refinancing

Here are some powerful strategies to lighten your financial load:

Frequently Asked Questions

Looking for the best financial aid apps for students?

Check out these top picks:

1. Scholly

2. FAFSA

3. RaiseMe

4. Mint

5. Goodbudget

6. StudentAid.gov

Can these apps help me find scholarships?

Yes, these financial aid apps can help you find scholarships. Scholly and RaiseMe specifically focus on connecting students with scholarship opportunities.

Are these financial aid apps free to use?

The majority of these apps are free to download and use. However, some may have in-app purchases or premium features that require a fee.

Do these apps provide information on student loans?

Yes, many of these financial aid apps provide information on student loans, including interest rates, repayment options, and loan forgiveness programs.

Can I track my expenses and budget using these apps?

Take control of your finances today! Use apps like Mint and Goodbudget to track your expenses and create a budget.

Do these apps have resources for international students?

Some of these financial aid apps, such as FAFSA and StudentAid.gov, may have resources for international students. However, it is important to check with your school’s financial aid office for specific resources tailored to international students.