How to Avoid Financial Aid Scams

Navigating the world of financial aid can feel overwhelming, particularly with the increasing prevalence of scams aimed at students and families. This article serves as your guide to understanding the various types of financial aid scams you may encounter, pinpointing the warning signs that could help you avoid becoming a victim.

You ll find practical steps to safeguard yourself, along with resources for reporting any suspicious activity you might come across. You can also explore other funding options to ensure you stay focused and undeterred by scams on your educational journey.

Contents

Key Takeaways:

- Know the types of scams and their tactics.

- Beware of requests for money upfront.

- Verify offers and never share personal information.

Understanding Financial Aid Scams

Understanding financial aid scams is essential for you as a student seeking scholarships while navigating the complex world of funding your education.

Many individuals, like Haley DeLeon, have unfortunately become victims of these tricks, which can involve high-pressure sales tactics and false promises of guaranteed scholarships. These scams often lead to identity theft, which is when someone uses your personal information without your permission, or the loss of personal information.

They can easily disguise themselves as legitimate financial aid offers, making it crucial for you to recognize the warning signs. Seeking guidance from credible financial aid offices and trusted resources is vital to safeguard your future.

Types of Scams and How They Work

Various types of financial aid scams are out there, each using clever tactics to trick you into giving up your hard-earned money or personal information.

One common scheme has scammers demanding upfront application fees for scholarships that sound too good to be true, luring you in with promises of guaranteed awards. These schemes often feature flashy websites filled with glowing testimonials from supposed beneficiaries carefully crafted to create an illusion of credibility.

Another tactic you might encounter is the fraudulent scholarship offer that claims all you need to do is provide some personal information or pay a minimal fee to access financial assistance. By highlighting urgency and tempting you with terms like “exclusive” or “limited-time offer,” these scams prey on vulnerability and hope, pushing many to make snap decisions.

Knowing these red flags can empower you to navigate the financial aid landscape more securely.

Red Flags to Look Out For

Identifying red flags is crucial for steering clear of financial aid scams. Many offers may appear legitimate at first glance, yet they often hide deceptive dangers.

Look out for common warning signs, such as:

- Requests for upfront fees for scholarship matching services

- Promises of guaranteed scholarships that disregard standard eligibility criteria

Stay alert! Recognizing these signs can save you from potential scams and help safeguard your financial information.

Signs of a Potential Scam

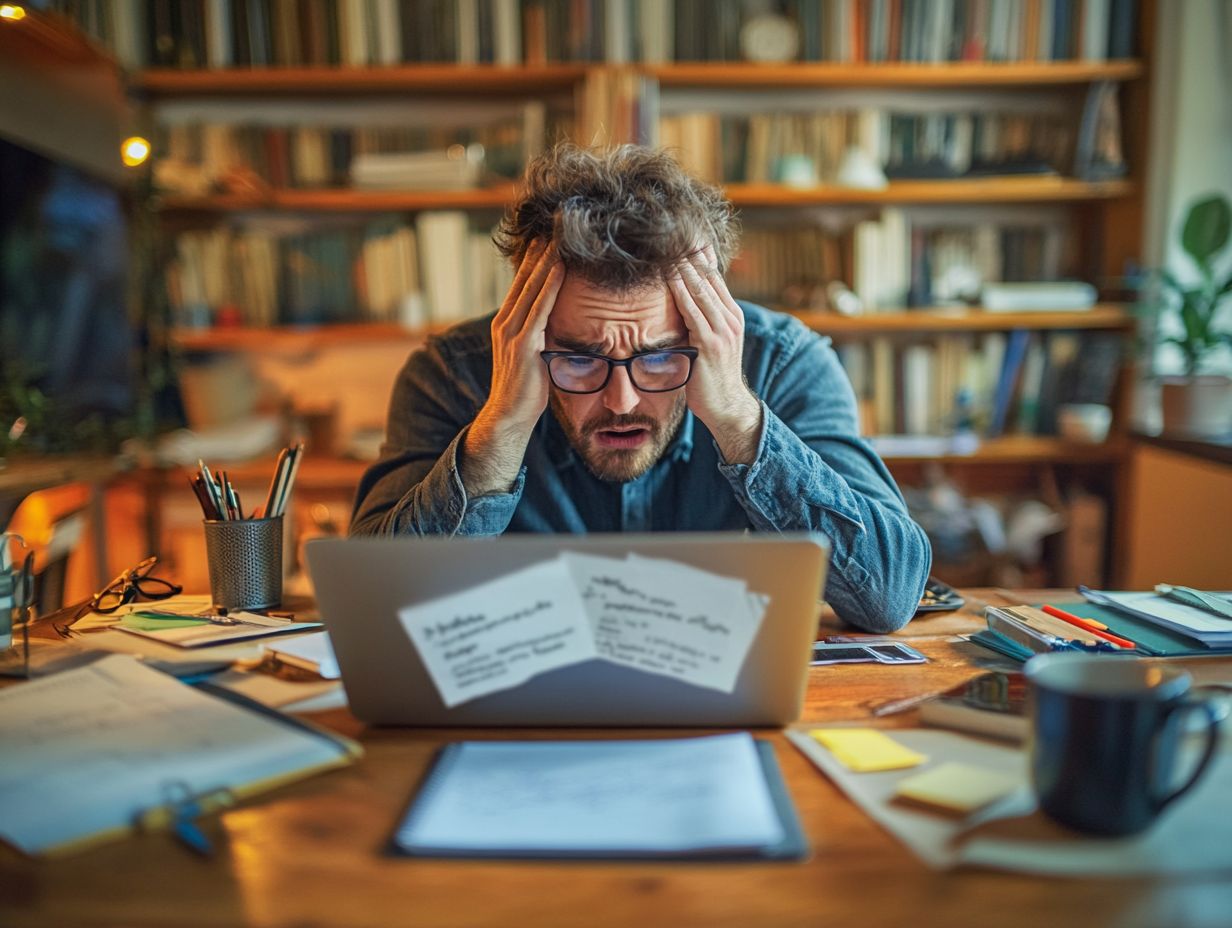

Signs of a potential scam often manifest as high-pressure sales tactics that urge you to act immediately, leaving you feeling rushed and uncertain about your decisions. These scams frequently lean on aggressive marketing strategies that promise unrealistic outcomes or swift financial gains.

While these offers may appear tempting, they often lack credibility and can lead you astray. Be wary of any requests for personal information, such as your Social Security number or bank details; these are significant red flags that should never be overlooked.

Ignoring them could result in the devastating consequences of identity theft, which can jeopardize your financial stability for years to come. Therefore, it’s essential for you to consult your financial aid office for accurate information and guidance.

They can provide the resources and support you need to navigate these potential pitfalls safely. Don t wait! Protect yourself today by using the tips in this guide!

Protecting Yourself from Scams

Protecting yourself from financial aid scams is essential.

Take action to safeguard your personal information and finances.

- Research potential scholarship offers thoroughly.

- Carefully check if organizations are real.

- Firmly resist high-pressure sales tactics.

By staying informed and vigilant, you can greatly decrease your vulnerability to identity theft and financial aid scams.

Steps to Take to Avoid Scams

To steer clear of financial aid scams, start by consulting your financial aid office for legitimate resources and guidance during the application process.

It s crucial to verify the legitimacy of any scholarship offers by researching the organization behind them and ensuring they don t require any upfront payment.

Familiarize yourself with the eligibility requirements, which can vary significantly between programs. This will help you better assess how well you align with the scholarship terms.

Engage with your financial aid office to learn critical aspects of the application process, including important deadlines and necessary documentation. This proactive approach is vital for successfully navigating the complex landscape of financial aid.

Resources for Reporting Scams

When you come across financial aid scams, it is essential to know how to report them. This can help shield others from becoming victims of similar schemes.

Organizations such as the U.S. Federal Trade Commission, the Better Business Bureau, and the National Fraud Information Center offer vital support and guidance.

You can also contact your state attorney general for help in tackling these fraudulent activities.

Where to Seek Help and Report Scams

If you encounter financial aid scams, know where to turn for help and how to report these incidents to the appropriate authorities, such as the U.S. Federal Trade Commission and the Better Business Bureau.

These organizations are pivotal in maintaining the integrity of financial assistance. They investigate fraudulent activities and educate the public on recognizing scams.

To effectively report a scam, gather all pertinent information, including:

- Communication records

- Any financial transactions made

- Details about the scammer

Once you ve compiled this information, visit the FTC’s website to file an online complaint. You can also reach out to the Better Business Bureau for additional guidance. Don t forget that your school s financial aid office is another valuable resource; they can provide insight into legitimate options and support.

Documenting your allegations with these entities is not just a formality it s a crucial step in combating fraudulent schemes and ensuring future students are protected.

Alternative Options for Financial Aid

Exploring alternative financial aid options can open up legitimate pathways for funding your education. This helps reduce reliance on potentially fraudulent scholarships.

Consider a variety of funding sources, including:

- Research grants

- Explore educational loans

- Seek institutional aid

All of these can be accessed through verified financial aid offices and credible resources. This approach enhances your financial strategy and ensures your educational journey remains secure and well-supported.

Act now to protect your future! Visit the FTC’s website for more information and resources.

Exploring Other Sources of Funding

Exploring alternative funding sources, such as grants and educational loans, can provide reliable financial aid. These options can often be more stable than many scholarships.

Grants are especially appealing because they don t need to be paid back. Educational loans can offer lower interest rates and flexible repayment plans to suit your budget.

Also, make sure to use scholarship databases. These platforms gather verified opportunities from different institutions, helping you find funding tailored to your interests and achievements.

Frequently Asked Questions

What are financial aid scams?

Financial aid scams trick people looking for education funding. They often promise easy financial aid, but their real aim is to steal personal information or money.

How can I identify a financial aid scam?

Watch for red flags like being asked to pay upfront or promises of guaranteed funds. If someone pressures you to act quickly, be cautious.

What should I do if I think I have been targeted by a financial aid scam?

Stop all communication with the scammer. Do not share personal information or send money. Report the scam to your school s financial aid office or the Federal Trade Commission.

How can I protect myself from financial aid scams?

Be careful and do your research. If an offer seems too good to be true, check it out before proceeding. Regularly monitor your information for any signs of compromise.

Are there legitimate ways to pay for college without financial aid?

Yes! You can use scholarships, grants, part-time jobs, and savings. Apply for scholarships early to cut tuition costs.

Is it safe to share my personal information when applying for financial aid?

It can be safe, but always take precautions. Only share your details on secure websites and with trusted sources.

Start researching funding options today to secure your financial future! Explore scholarship databases and consult with financial aid offices to maximize your opportunities.