Understanding the Benefits of Community College Aid

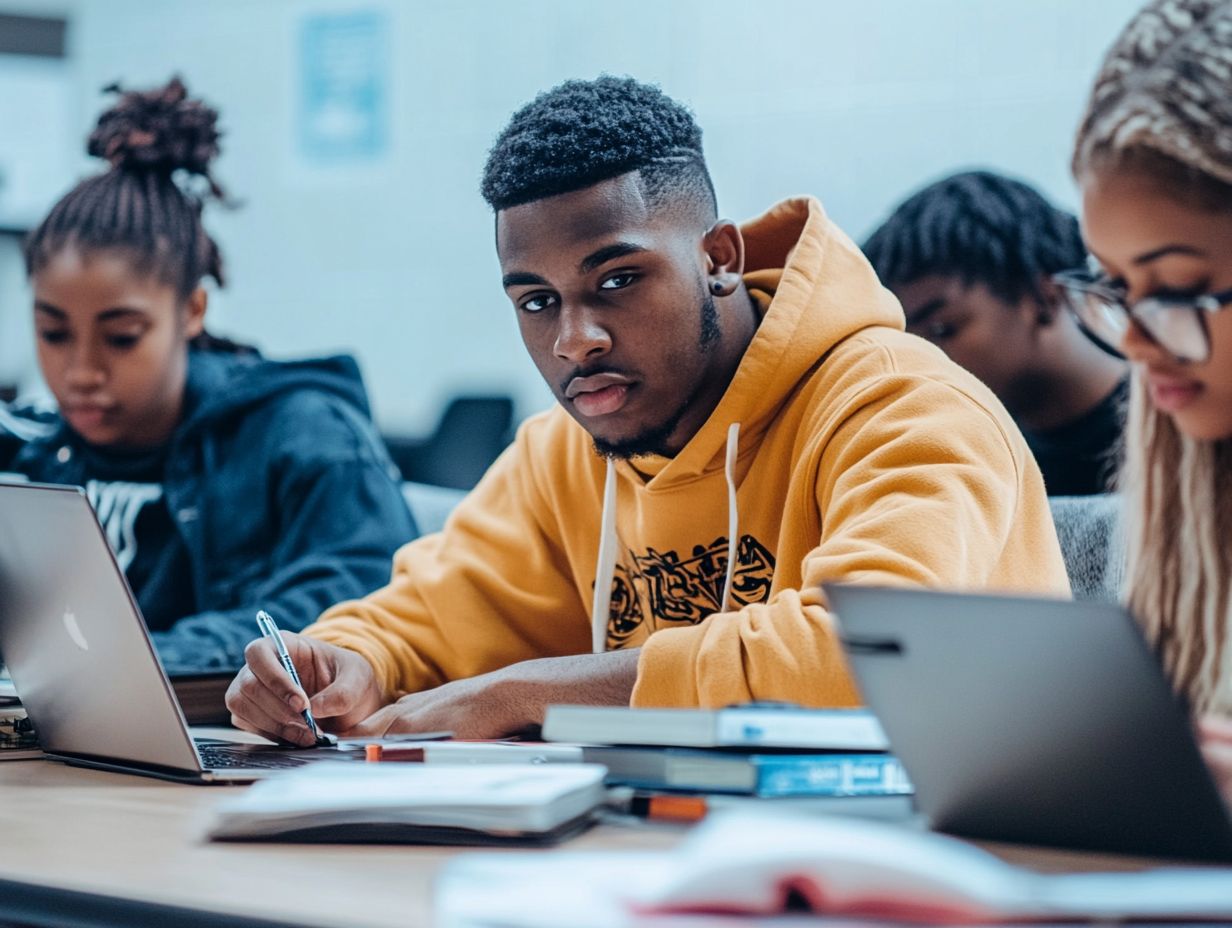

Navigating the world of higher education can feel overwhelming, particularly when it comes to financing your studies. Community college aid presents a range of options specifically designed to help you manage the costs of your education and reach your academic aspirations.

From grants and scholarships to loans and work-study programs, grasping the various types of aid available is essential for your success. This article delves into the different forms of community college aid, outlines eligibility requirements, explains the application process, and addresses common misconceptions.

By the end, you ll be well-equipped to make informed decisions about your educational journey.

Contents

Key Takeaways:

- Community college aid makes education affordable for everyone.

- Eligibility depends on factors like income and grades.

- Applying is a straightforward process with various forms of support available.

What is Community College Aid?

Community College Aid stands as important support in the higher education landscape, designed to help pay for college for those like you pursuing a low-cost associate degree. This form of aid can significantly ease the burden of tuition fees. It allows you to explore various educational pathways without the daunting weight of student loans.

With programs from the U.S. Department of Education and the FAFSA process at your disposal, you can unlock exciting financial assistance options, including grants and scholarships, making community colleges a feasible and appealing choice.

Beyond federal grants and state scholarships, community colleges often present their own institutional aid programs specifically designed to meet the unique needs of students. These funds are essential in promoting access to education, empowering individuals from diverse backgrounds to overcome financial hurdles.

Financial aid not only alleviates immediate financial strain but also empowers you to concentrate on your studies, engage in extracurricular activities, and pursue internships that enrich your academic journey. By fostering a nurturing environment, community college aid enhances your overall success, guiding you toward the achievement of your academic and career goals while contributing to a more educated workforce.

Types of Community College Aid

Community colleges present an array of financial aid options, establishing themselves as an accessible choice for those pursuing higher education.

You ll find various forms of aid available, including:

- Grants

- Scholarships

- Student loans

- Work-study programs

Each is tailored to bolster your financial and academic journey. Federal grants, like the Pell Grant and TEACH Grant, alongside state grants, offer funding that you won t need to repay.

Meanwhile, Direct Subsidized Loans and work-study programs provide added support for those who meet the qualifications, ensuring you can focus on your studies without the heavy burden of financial stress.

Grants and Scholarships

Grants and scholarships are vital resources in the realm of community college aid, offering you significant financial assistance that doesn t require repayment.

The Pell Grant, administered by the U.S. Department of Education, specifically targets low-income students, while the TEACH Grant is tailored for those aspiring to enter the teaching profession.

Together, these financial resources can lighten the load of tuition fees, allowing you to concentrate fully on your academic and personal growth.

Each of these funding options comes with its own set of eligibility criteria and application processes, making it essential for you to understand your unique qualifications and the steps required to secure this aid.

For example, grants often require you to demonstrate financial need through the Free Application for Federal Student Aid (FAFSA), while scholarships may consider your merit-based achievements, community service, or specific talents.

The impact of successfully obtaining these forms of assistance can be transformative; they not only reduce the overall cost of your education but also empower you to pursue advanced degrees or certifications.

This, in turn, enhances your career prospects and contributions to society, elevating both your personal and professional journey.

Loans and Work-Study Programs

Loans and work-study programs are important ways to get financial help at community colleges. They provide effective options to manage your educational costs. Each of these financial resources has its own unique advantages and considerations that deserve your attention.

Federal loans, for example, often have lower interest rates and more flexible repayment plans, making them a compelling choice for many students. In contrast, private loans can present a mixed bag of terms and conditions, which might introduce some risk to your financial planning.

Work-study programs not only offer financial relief but also serve as a platform for you to build valuable skills and forge important connections in your chosen field. By understanding the distinctions between these options, you can take charge of your financial future and make informed decisions about financing your education.

Eligibility for Community College Aid

Eligibility for community college aid hinges on specific requirements and criteria that you must meet to unlock financial assistance.

The Free Application for Federal Student Aid (FAFSA) process is an essential step in this journey, enabling you to apply for both federal and state financial aid tailored to your financial circumstances.

Factors like your income, residency, and enrollment status are important in determining your eligibility, ensuring that aid is allocated to those who truly need it most.

Requirements and Criteria

The requirements and criteria for obtaining community college aid are crucial if you’re seeking financial assistance. These criteria typically include your academic performance, income level, and the completion of the FAFSA application to assess your financial need.

Community colleges strive to support a diverse array of students, so it s vital for you to grasp the specific requirements that can unlock valuable financial aid resources. Many community colleges offer scholarships based on factors like your field of study, extracurricular involvement, or residency status, which can further expand your financial options.

Eligibility can also differ by state, with some areas providing grants specifically for low-income individuals or those pursuing high-demand career paths. Understanding these various forms of aid helps you navigate the funding landscape more effectively.

This comprehensive approach underscores community colleges’ commitment to making higher education affordable and inclusive. It ultimately gives you the power to pursue your educational goals and enhance your career prospects.

How to Apply for Community College Aid

Applying for community college aid is a structured journey that starts with mastering the FAFSA process, a vital step in securing the financial assistance you need.

You ll want to gather your personal and financial information meticulously to ensure that your FAFSA application is completed accurately. Remember to stay vigilant about the deadlines set by your chosen institution.

By following these essential steps, you can maximize your financial aid opportunities and lay a solid foundation for a successful educational experience.

Step-by-Step Application Process

The step-by-step application process for community college aid begins with completing the FAFSA. This is where you ll provide important financial information to determine your eligibility for financial aid. This step is crucial for unlocking various funding options, including grants, loans, and work-study programs that pave a cost-effective path to higher education.

By completing the FAFSA accurately and promptly, you significantly boost your access to available resources.

After you fill out the FAFSA, the next step is to gather necessary documents like tax returns, W-2 forms, and your Social Security number. These documents will help paint an accurate financial picture of your situation. Once you have everything collected, make sure to double-check the information for accuracy before hitting that submit button.

After submitting the FAFSA, it s a good idea to reach out to your chosen community colleges. Inquire about any specific financial aid applications or additional forms they might require. Regular follow-ups will keep you informed about the status of your aid applications and available scholarships, ensuring you fully leverage the financial support options accessible to you.

Benefits of Community College Aid

The benefits of community college aid are truly multifaceted. It provides substantial financial assistance that significantly reduces tuition and living expenses for those pursuing higher education.

By offering access to grants, scholarships, and low-interest loans, community colleges empower you to pursue a quality education without the burden of overwhelming debt.

Personalized support from academic advisors boosts your chances of success. This enriches the overall college experience, making it more rewarding.

Financial Assistance and Reduced Costs

Financial assistance from community college aid can significantly reduce your tuition fees. This makes education easier to afford.

With options like grants and scholarships at your disposal, you can alleviate the financial burden of your studies. This allows you to concentrate on your academic goals without the weight of high costs.

This affordability is a compelling reason why many students view community college as a practical and attractive option for their higher education journey.

Take, for instance, programs like the Pell Grant. The Pell Grant helps students from low-income families pay for college, covering a significant portion of tuition and fees.

State-funded initiatives often offer scholarships specifically designed for certain fields of study, such as nursing or renewable energy. These resources equip you for success.

Community colleges frequently collaborate with local businesses to create internship opportunities. This enhances your employability while easing financial strain through valuable hands-on experience.

These programs not only help reduce education costs but also contribute to building a more skilled workforce, benefiting both you and the community as a whole.

Opportunities for Higher Education

Community college aid opens up a world of opportunities for you. It provides access to programs that allow for a smooth transfer of credits to four-year institutions.

With personalized support from academic advisors, you can navigate your educational journey more effectively and make informed decisions about your future career.

This support system, combined with the affordability of community colleges, significantly enhances your chances for a brighter academic future.

Partnerships between community colleges and universities create a strong framework to facilitate your transition from two-year to four-year programs.

These collaborations often come with guaranteed admission agreements, giving you a clear roadmap toward achieving your degree aspirations.

Build relationships with your academic advisors, as they play a crucial role in identifying transfer pathways that align with your individual goals.

By leveraging these resources, you can maximize your educational investments while minimizing debt, ultimately positioning yourself for success in an increasingly competitive job market.

Common Misconceptions about Community College Aid

Misconceptions about community college aid often stand in the way of your pursuit of higher education. You might think that community colleges fall short of the quality and resources offered at four-year universities, or perhaps you believe that financial aid is scarce or difficult to access.

However, grasping the true nature of community college aid can empower you to embark on a cost-effective journey that doesn t compromise your academic goals.

Don’t let misconceptions hold you back. Explore community college aid today and start your journey toward a brighter future!

Debunking Myths and Clarifying Facts

Clearing up the myths about community college and its financial aid options is essential for you as a prospective student seeking assistance in higher education. Many believe that community colleges lack quality education or that financial aid is limited and hard to access.

Here’s the truth: community colleges frequently provide accredited programs, diverse faculty, and an abundance of financial aid opportunities, including federal and state grants. This makes them a compelling and budget-friendly choice. Understanding the facts gives you the power to make informed decisions.

For instance, nearly two-thirds of community college students receive some form of financial aid, according to the National Center for Education Statistics. Many community colleges have funds for students who may not qualify for federal aid yet still require support.

Some individuals think community college degrees hold less weight in the job market. However, research shows that employers genuinely value the skills and hands-on training offered at these institutions, often leading to promising career pathways.

Frequently Asked Questions

What is community college aid?

Community college aid refers to financial assistance, such as grants, scholarships, and loans, that is specifically available to students attending a community college. This aid helps students cover tuition, fees, books, and other necessary expenses.

Who is eligible for community college aid?

Eligibility for community college aid varies depending on the type of aid and specific requirements set by the institution or organization providing the aid. Generally, aid is available to students who demonstrate financial need, are enrolled in an eligible program, and maintain satisfactory academic progress.

How can community college aid benefit me?

Community college aid can benefit you in several ways. It can help cover the cost of tuition and other educational expenses, making it more affordable to attend college. It can also reduce the amount of student loans you need to take out, and in some cases, it can even cover all your costs, allowing you to graduate debt-free.

What are the different types of community college aid?

There are several types of aid available to community college students, including federal and state grants, scholarships from private organizations, and loans. Some community colleges also offer institutional aid, such as tuition waivers or work-study programs.

Do I have to repay community college aid?

It depends on the type of aid you receive. Grants and scholarships are typically considered gift aid and do not need to be repaid. However, loans do need to be repaid with interest. It’s important to carefully review the terms and conditions of any aid you receive to understand if and when repayment is required.

How can I apply for community college aid?

The process for applying for community college aid varies depending on the type of aid. Generally, you will need to complete the Free Application for Federal Student Aid (FAFSA), the form used to apply for federal student aid, to be considered for federal and state aid. Some private scholarships may have their own application process. Apply as soon as possible to boost your chances of receiving aid!

Explore community college opportunities or reach out for more information!