Federal vs. State Financial Aid: Key Differences

Navigating the world of financial aid can indeed feel overwhelming, but grasping the differences between federal and state aid is essential for planning effectively your education funding.

This article explores federal and state financial aid. It covers eligibility and the types available from grants to loans and work-study programs. It also provides a thorough guide through the application process, emphasizes crucial deadlines, and explores repayment options for loans.

By the end, you’ll have the know-how to take charge of your financial future!

Contents

- Key Takeaways:

- Overview of Federal and State Financial Aid

- Eligibility for Federal and State Financial Aid

- Types of Federal and State Financial Aid

- Application Process for Federal and State Financial Aid

- Award Amounts for Federal and State Financial Aid

- Repayment Options for Federal and State Loans

- Frequently Asked Questions

- What is the difference between federal and state financial aid?

- Can I receive both federal and state financial aid?

- How do I apply for federal financial aid?

- How do I apply for state financial aid?

- Are there any key differences in eligibility requirements for federal and state financial aid?

- Which type of financial aid should I prioritize?

Key Takeaways:

Federal and state aid helps students pay for college in different ways.

Eligibility for federal aid is determined by the Free Application for Federal Student Aid (FAFSA), a form that helps assess your financial need, while state aid eligibility requirements vary.

Award amounts for federal and state aid are determined by factors such as financial need, cost of attendance, and availability of funds.

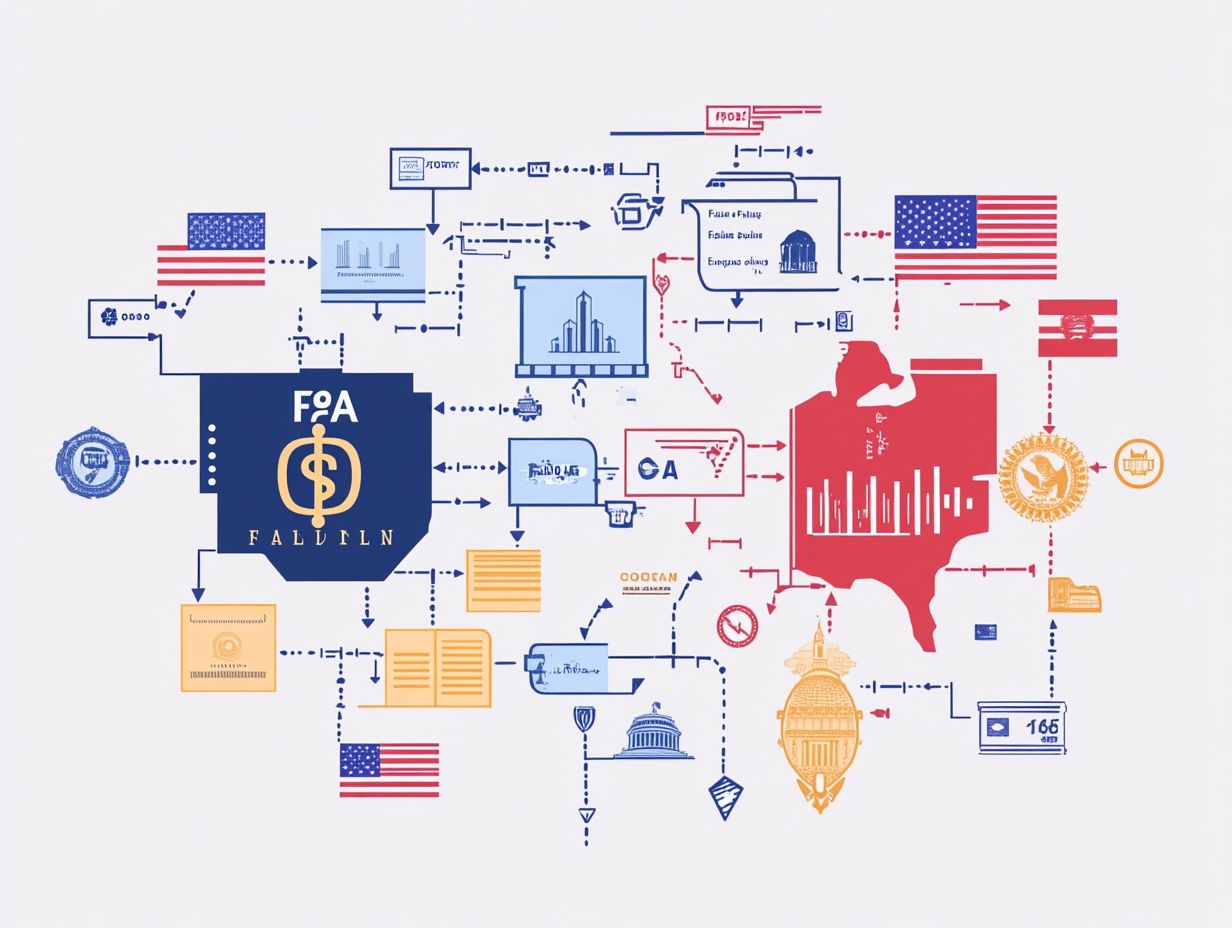

Overview of Federal and State Financial Aid

Federal and State Financial Aid offers a range of financial assistance options tailored to help you afford your education. This support is crucial! It helps students from various backgrounds afford quality education while alleviating the financial strain often associated with attending both public and private colleges.

Programs like the FAFSA application simplify the process as you seek federal grants, state scholarships, and institutional aid, ensuring your financial needs are addressed through various resources.

Understanding these financial aid options is key for you and your family as you navigate the complexities of funding your education effectively.

What are Federal and State Financial Aid?

Federal and State Financial Aid encompasses the financial assistance offered by the U.S. government and individual states to support you in your pursuit of higher education. Navigating these financial resources can profoundly influence your educational journey.

It is crucial to understand how federal aid, such as Pell Grants which are granted based on financial need can provide a significant boost, particularly for low-income students like yourself.

On the other hand, state aid often focuses on specific demographics or fields of study, encouraging local residents to pursue higher education within their home states.

The Free Application for Federal Student Aid (FAFSA) plays a pivotal role in this landscape, acting as your gateway to both federal and many state financial aid programs. By completing the FAFSA, you position yourself not only for federal support but also for various state scholarships, making it an essential step in alleviating the financial burden of your education.

Eligibility for Federal and State Financial Aid

Eligibility for Federal and State Financial Aid hinges on several factors, primarily centering around your financial need. As a prospective student, you’ll need to complete the FAFSA application, which evaluates your financial situation based on criteria like income level, family size, and the cost of attendance for your chosen accredited program.

Meeting these requirements is crucial for qualifying for an array of financial aid resources, including grants, loans, and scholarships. Understanding these eligibility criteria will not only help you navigate your options but also enhance your chances of securing the financial support essential for achieving your educational aspirations.

Requirements and Qualifications

To qualify for Federal and State Financial Aid, you must meet specific requirements set by the U.S. Department of Education and various state scholarship programs. Typically, this means being a U.S. citizen or an eligible non-citizen, maintaining satisfactory academic progress, and demonstrating financial need through your FAFSA (Free Application for Federal Student Aid) application.

Some state financial aid programs may require you to be a resident or restrict eligibility based on your chosen field of study or degree level. It’s crucial to maintain a minimum grade point average (GPA) to keep your eligibility.

While federal aid primarily focuses on credit completion and overall academic performance, individual states may have different standards. Falling below these benchmarks could result in losing your funding, so it’s important to stay informed about both federal regulations and state-specific guidelines.

Engaging with financial aid advisors can provide valuable insights into navigating these requirements confidently.

Types of Federal and State Financial Aid

Understanding the different types of Federal and State Financial Aid is essential for students seeking assistance to fund their education.

Federal financial aid primarily includes grants, such as the Pell Grant, which you won t need to repay. Loans, like Direct Subsidized and Unsubsidized Loans, do require repayment with interest.

State financial aid often mirrors these grant programs and provides work-study opportunities, allowing you to earn money while studying.

Don’t overlook private scholarships; they are a valuable resource to help manage your education costs.

Grants, Loans, and Work-Study Programs

Grants, loans, and work-study programs are the three primary types of financial aid available to you under Federal and State Financial Aid.

Grants are typically awarded based on financial need and do not require repayment, making them a highly appealing option.

Loans, however, must be repaid with interest, including both federal Direct Subsidized Loans and Direct Unsubsidized Loans.

Work-study programs allow you to earn money through part-time employment while attending school, helping to cover tuition and living expenses. Understanding these options is crucial for your success!

Grants can significantly lighten your financial load without the burden of future repayments, although their availability and eligibility criteria may pose challenges.

Loans provide immediate funding but can lead to hefty debt upon graduation if not managed wisely. It’s essential to carefully assess your borrowing needs.

Work-study programs offer financial relief and valuable work experience, but be mindful they can sometimes conflict with your academic commitments.

By understanding all these financial aid types, you can make informed choices that align with your academic aspirations and financial goals.

Application Process for Federal and State Financial Aid

The application process for financial aid can be tricky. Start by completing the FAFSA. This essential document evaluates your financial need and establishes your eligibility for various federal and state financial aid programs.

To maximize your financial aid opportunities, it’s crucial to adhere to deadlines, ensuring your applications are processed on time. A clear understanding of the entire application process is vital for securing the necessary funding for your accredited education program.

Steps to Apply and Important Deadlines

Applying for Federal and State Financial Aid involves essential steps that you must follow carefully, including specific deadlines tied to the FAFSA application.

Start by gathering the necessary documents, such as tax returns and bank statements. It’s important to submit your application by the established deadlines to qualify for the maximum financial aid available from both federal and state sources. This can significantly reduce your educational expenses!

Once you have all the required documents, take your time to fill out the FAFSA form accurately. Double-check every detail to avoid delays. Remember the priority deadlines for state aid; many states operate on a first-come, first-served basis when distributing funds.

To stay organized, consider creating a checklist of all required documents and deadlines. Digital tools or apps can be invaluable for tracking these important dates effectively. Regularly review emails and updates from financial aid offices to ensure you don t miss any critical notifications regarding your applications. This maximizes your potential support!

Award Amounts for Federal and State Financial Aid

The award amounts for Federal and State Financial Aid can vary significantly based on key factors. These include your financial need, the cost of attendance, and the type of educational institution you choose to attend.

Federal financial aid programs, such as Pell Grants and subsidized loans, have specific maximum awards set by the U.S. Department of Education. State financial aid may impose different limits based on state budgets and individual financial needs.

Understanding these award amounts is crucial as you plan and budget for your educational expenses!

Factors that Determine Award Amounts

Several factors play a critical role in determining the award amounts for both Federal and State Financial Aid. This starts with your demonstrated financial need, as assessed through the FAFSA application.

Key elements include the total cost of attendance at your chosen institution, your expected family contribution, and the specific guidelines set by federal and state financial aid programs.

Understanding these factors helps you effectively plan for your educational expenses and maximize your potential aid. For instance, public colleges typically offer a lower price compared to private institutions, which often come with higher tuition fees. This variance can significantly impact the amount of aid you might receive.

At a public university, you might find your financial aid award covering a substantial portion of your expenses. However, at a private college, you may need additional financial support to bridge the gap.

Your expected family contribution is based on income and asset levels, which further influences how much funding you ultimately receive. As you navigate these complexities, grasping the interplay of these factors enables you to make informed decisions about financing your education.

Repayment Options for Federal and State Loans

Repayment options for Federal and State Loans are vital as you consider your long-term financial responsibilities.

For instance, Federal loans like Direct Subsidized and Unsubsidized Loans usually come with a generous six-month grace period after graduation before repayments begin.

Many repayment plans exist, allowing you to tailor your payments according to your income and financial situation. This flexibility ensures you can meet your loan obligations without unnecessary strain.

Understanding these options is crucial for making informed choices about your financial future!

Grace Periods and Repayment Plans

Grace periods and repayment plans are essential as you navigate the complexities of federal and state loans. They provide the crucial breathing room you need when stepping into the workforce.

Typically, a grace period spans six months for federal loans, during which you don t have to make payments. This allows you to secure employment and establish a solid financial footing.

Once the grace period ends, various repayment plans are available to you:

- Standard Repayment Plan: This involves fixed monthly payments over a decade, offering straightforward budgeting. However, it may result in higher monthly payments.

- Graduated Repayment Plan: This plan starts with lower payments that gradually increase, making it suitable for those expecting a significant income boost after graduation.

- Income-Driven Repayment Plans: These plans allow for flexible monthly payments based on your income and family size, significantly alleviating financial pressures.

Each of these plans comes with its advantages, such as potential loan forgiveness for income-driven options, but they also have downsides, including the possibility of accruing more interest over the life of the loan.

This video explains various repayment options in detail. Be sure to check it out!

Frequently Asked Questions

What is the difference between federal and state financial aid?

Federal financial aid is provided by the government and includes grants, loans, and work-study programs. On the other hand, state financial aid comes from individual states and may include grants, scholarships, and loans.

Can I receive both federal and state financial aid?

Yes, you may be eligible for both types of financial aid. Your eligibility and the amount you receive can vary based on your financial need and the availability of funds.

How do I apply for federal financial aid?

To apply for federal financial aid, you must complete the Free Application for Federal Student Aid (FAFSA), which can be done online or via a paper form.

How do I apply for state financial aid?

Each state has its own application process for state financial aid. You can usually find the application on your state’s Department of Education website.

Are there any key differences in eligibility requirements for federal and state financial aid?

Yes, eligibility requirements for federal and state financial aid can differ. Federal aid primarily depends on financial need, while state aid may consider other factors such as academic achievement or residency requirements.

Which type of financial aid should I prioritize?

Both federal and state financial aid can significantly help you pay for college. It s crucial to research the terms and conditions of each type of aid to see which one best meets your needs.

In conclusion, understanding your financial aid options is vital for managing your education costs effectively. Take the time to explore your choices and apply for aid to secure your financial future.