How to Utilize Financial Aid for Online Learning

Navigating the world of online education can feel like a daunting task, especially when it comes to financing your studies.

Understanding the various types of financial aid available is essential for making informed decisions that benefit your educational journey.

This article outlines eligibility requirements. It also guides you through the application process and shares strategies to help you get the most financial support.

Explore alternative funding options such as scholarships, grants, and loans to ensure you have all the resources necessary to thrive in your online learning experience.

Contents

- Key Takeaways:

- Understanding Financial Aid for Online Learning

- Eligibility for Financial Aid

- Applying for Financial Aid

- Maximizing Financial Aid for Online Learning

- Other Sources of Funding for Online Learning

- Frequently Asked Questions

- What is financial aid and how can it be used for online learning?

- What types of financial aid are available for online learning?

- How do I apply for financial aid for online learning?

- Can I use financial aid for any online learning program?

- What happens after I receive my financial aid for online learning?

- What are the consequences of misusing financial aid for online learning?

Key Takeaways:

Research and understand the different types of financial aid available for online learning, such as scholarships, grants, and loans.

Check your eligibility and make sure you meet the requirements and qualifications for financial aid before applying.

Maximize your financial aid by strategizing and discovering the importance of financial aid for online students to get the most out of it for your online learning journey.

Understanding Financial Aid for Online Learning

Knowing about financial aid is crucial for anyone wanting to achieve a higher education online.

Financial aid encompasses a range of support options, including federal aid, grants, scholarships, and student loans, all designed to make it easier on your wallet.

By understanding financial aid options, you can maximize your educational opportunities and ensure that you meet your financial needs while staying on track academically.

This guide will explore the various types of financial aid, eligibility criteria, and application processes, allowing you to make informed decisions about funding your education.

Types of Financial Aid Available

There are numerous types of financial aid available to you as you pursue your online program, each tailored to meet different financial needs and circumstances.

Understanding these options gives you the power to make informed decisions about your education.

For example, grants like the Pell Grant are awarded based on financial need and don t require repayment. They provide a vital financial cushion for many learners like yourself.

Scholarships, whether merit-based or need-based, also fall into this category, offering financial relief without the burden of loans.

However, student loans, including Direct Subsidized and Direct Unsubsidized Loans, do require repayment, but they come with various repayment plans designed to ease the process for graduates.

Additionally, work-study programs enable you to gain meaningful work experience while helping to cover your educational expenses.

Together, these various forms of aid create a full support system for you as you navigate the challenges of online education.

Eligibility for Financial Aid

Eligibility for financial aid is determined by a blend of factors, including your financial need, academic progress, and enrollment in accredited institutions.

The Free Application for Federal Student Aid (FAFSA) serves as a key tool in evaluating your eligibility for federal aid, encompassing grants, scholarships, and loans.

Grasping the eligibility requirements is essential for you as you pursue the financial support needed to facilitate your online education.

Requirements and Qualifications

To qualify for financial aid, you must show financial need and keep up with your studies at accredited institutions.

The FAFSA is your first step; it helps determine your eligibility based on family income and household size. Learn your institution’s unique qualifications for different types of aid.

This application opens doors to grants, loans, and work-study options tailored for you. Understanding how your financial need shapes your aid is crucial.

Your eligibility often depends on completing coursework and maintaining good grades. Staying informed lets you make the most of your financial aid options.

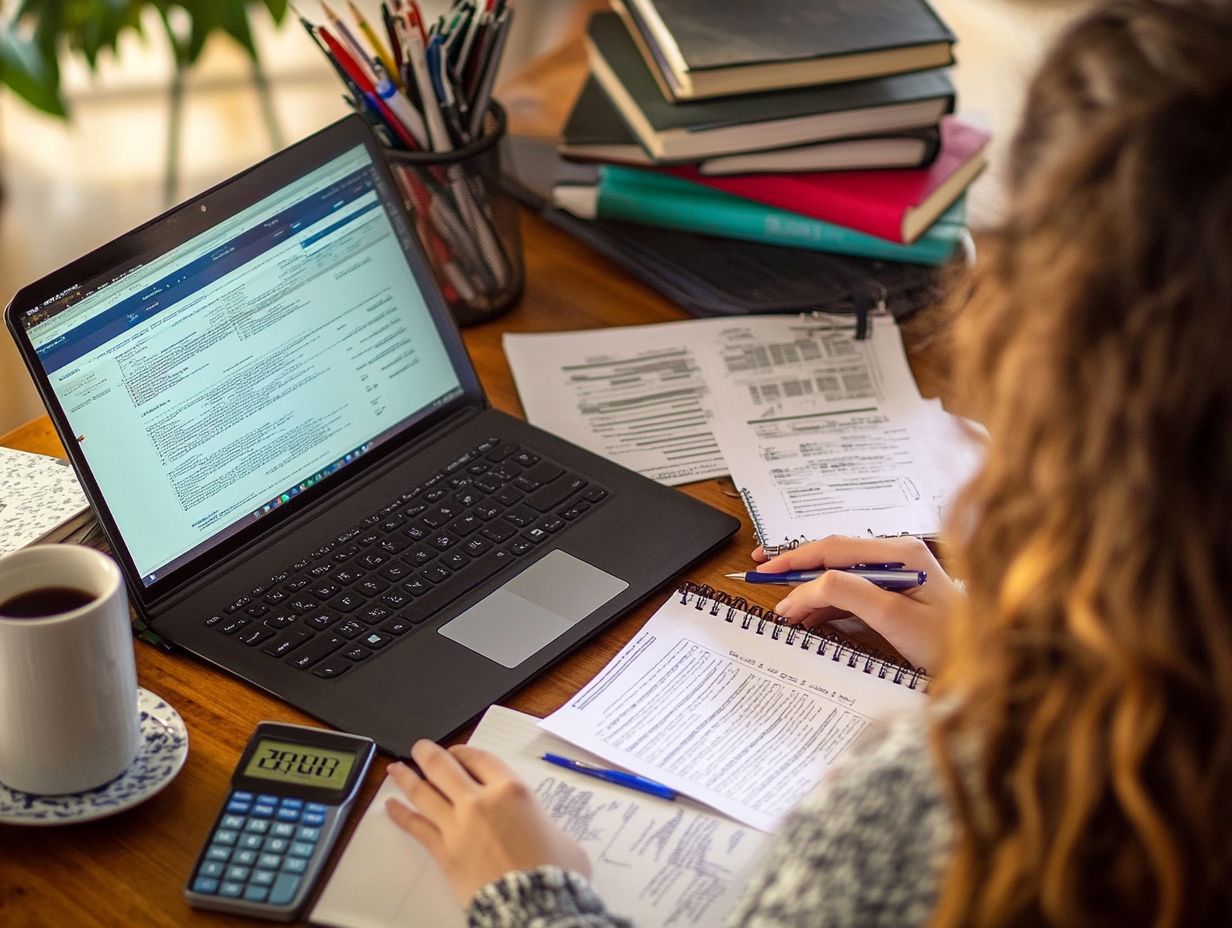

Applying for Financial Aid

Start by completing the FAFSA and submitting all required documents by the deadlines set by the federal government and your school.

The application process may vary based on the aid type: federal, state, or institutional. Understanding this helps you secure the support you need.

Step-by-Step Guide

This guide outlines the steps for applying for financial aid, helping you navigate the process effectively.

First, gather your tax returns and financial info. This will help you fill out the FAFSA, which is essential for determining your eligibility.

Once you have your documents, fill out the FAFSA carefully. Watch for details; small mistakes can delay your application.

After submitting the FAFSA, check for any additional forms your university might need. Staying informed is key.

Meeting deadlines is crucial since funding is often limited. Act quickly to maximize your financial aid package.

Stay organized and communicate with your financial aid office to boost your chances of getting the best support.

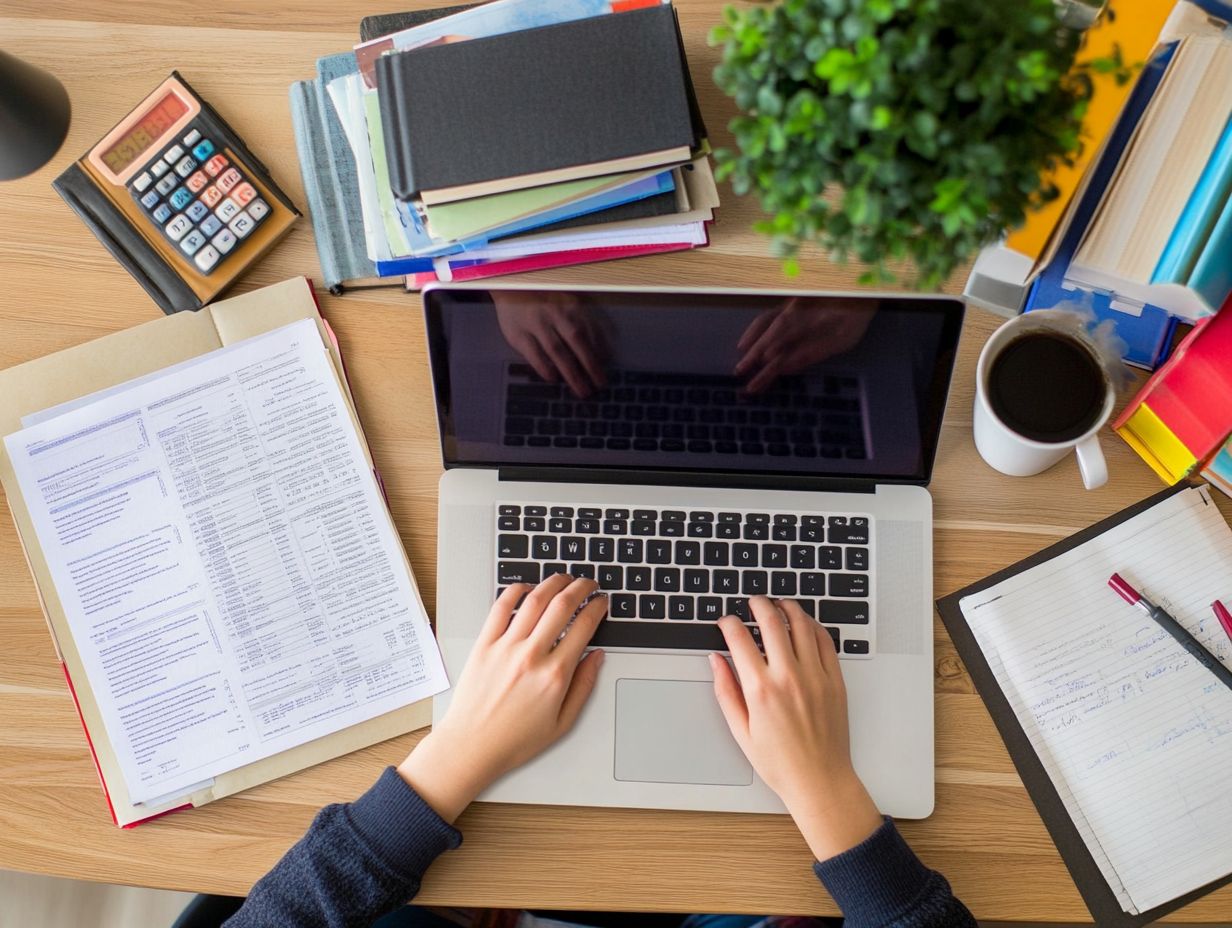

Maximizing Financial Aid for Online Learning

To make the most of financial aid, plan strategically and understand your options.

Seek scholarships and grants while taking full advantage of federal and state assistance to reduce your tuition costs.

Explore every opportunity to ensure a successful and enriching educational experience.

Strategies for Getting the Most Out of Aid

Implementing effective strategies can truly elevate your financial aid, empowering you to maximize your educational funds. By identifying and applying for scholarships and grants, and considering work-study programs, you have a wealth of opportunities to lighten your tuition burden and decrease your dependence on student loans.

One smart way to get more aid is to research available scholarships and grants, many of which go unclaimed simply due to a lack of applicants. Explore local organizations, community foundations, and online databases that cater specifically to your fields of study or personal background.

Getting involved in work-study programs not only provides vital help with costs but also equips you with invaluable work experience that can serve you well in your future career. By balancing your academics with part-time employment, you can enhance your financial aid packages, making your educational journey smoother and far less financially daunting.

Other Sources of Funding for Online Learning

In addition to traditional financial aid options, you can explore a range of alternative funding sources for your online learning journey.

Scholarships, grants, and employer assistance can boost your financial support, complementing federal aid and significantly easing your tuition costs.

Scholarships, Grants, and Loans

Navigating scholarships, grants, and loans is essential for funding your online education. Scholarships and grants are like golden tickets money that you don t have to repay while loans come with their own set of obligations.

It s essential to weigh your options carefully when considering federal and state aid. If you re enrolled in online programs, you ll find a plethora of funding opportunities designed to support learners from all walks of life.

Scholarships can be merit-based, recognizing your academic achievements, or need-based, focusing on your financial situation. Grants operate similarly, often awarded by the federal government or private organizations to assist low-income students.

Loans can cover a larger portion of your tuition costs, but they require thoughtful planning for repayment. To access these financial aids, you typically need to fill out the Free Application for Federal Student Aid (FAFSA). Keep in mind that eligibility criteria can vary significantly depending on the funding source.

Grasping these distinctions is fundamental for minimizing your overall financial burden as you pursue your education.

Frequently Asked Questions

What is financial aid and how can it be used for online learning?

Financial aid is financial assistance provided to students to help cover the costs of education. It can be used for tuition, books, supplies, and other related expenses. To effectively navigate financial aid for online master’s programs, students must be enrolled in an eligible program and institution, and must meet certain requirements set by the financial aid office.

What types of financial aid are available for online learning?

- Federal grants

- Federal loans

- State grants

- Scholarships

- Work-study programs

Students can also apply for private loans or seek financial assistance from employers and organizations.

How do I apply for financial aid for online learning?

To apply for financial aid for online learning, students must complete the Free Application for Federal Student Aid (FAFSA). This form will determine the student’s eligibility for federal and state grants, loans, and work-study programs. For those seeking more guidance, navigating financial aid for online bachelor’s degrees may also require additional forms or documentation from some schools.

Can I use financial aid for any online learning program?

Not all online learning programs are eligible for financial aid. To be eligible, the program must be offered by an accredited institution and must lead to a degree or certificate. It is important for students to check with their school’s financial aid office and review the top FAQs about financial aid for online degrees to ensure their chosen program is eligible for financial aid.

What happens after I receive my financial aid for online learning?

After receiving financial aid, students must use the funds to cover their education costs. This includes tuition, fees, books, and supplies.

Any remaining funds will be given to the student for other educational expenses. It’s vital for students to track their expenses and use their financial aid wisely.

What are the consequences of misusing financial aid for online learning?

Misusing financial aid can lead to big problems. If the funds aren t spent on educational expenses, students could be forced to repay the money.

Worse, they could lose access to future financial aid. Students must use their financial aid responsibly and follow all guidelines from their school s financial aid office.