The Importance of Financial Literacy for Students

In today s fast-paced world, mastering financial literacy can change your life. It’s more vital than ever, especially for students preparing to navigate their futures.

This article will explain what financial literacy truly means and why it s important. You’ll discover its profound impact on students’ lives, the benefits of being financially savvy, and the risks associated with financial illiteracy.

It offers effective teaching strategies, real-world applications, and practical tips to cultivate essential skills. By the end, you’ll recognize how mastering financial literacy can empower students for college and beyond, setting them on a path to success.

Contents

Key Takeaways:

Financial literacy is crucial for students to understand and manage their personal finances effectively. Having these skills leads to better financial decisions, fewer financial struggles, and a brighter future. Teaching financial literacy through practical strategies and real-world applications helps students prepare for college and beyond.

Understanding Financial Literacy

Understanding financial literacy is essential in today s economic environment. It equips you with the knowledge and skills to make informed financial decisions, enhancing your personal finance management.

This includes a wide range of topics, such as budgeting, saving, understanding credit, and managing debt effectively. Financial literacy helps you achieve financial independence, meaning having enough money to take care of yourself, significantly impacting your overall well-being.

With the increasing complexity of financial products and services, the demand for solid financial education becomes clearer, particularly for millennials facing intricate economic challenges.

Defining Financial Literacy and its Importance

Financial literacy is your ability to understand and manage various financial products and services. It s crucial for making informed financial decisions.

Key components include budgeting skills, which help you track income and expenses, so you can allocate your resources effectively. Saving money is another vital aspect that prepares you for unexpected expenses and helps you reach your financial goals.

Investing wisely is equally important; it involves knowing how to grow your wealth to ensure long-term financial security. By cultivating these skills, you foster financial responsibility and enhance your overall well-being, empowering you to navigate life’s uncertainties with confidence.

The Impact of Financial Literacy on Students

The impact of financial literacy on you as a student is profound. It shapes your ability to navigate complex financial landscapes and make informed decisions about your future, particularly in crucial areas such as student loans, budgeting, and credit management.

Benefits of Financial Literacy for Students

The benefits of financial literacy extend well beyond just improving academic performance. It cultivates a sense of financial confidence and encourages responsible financial habits that lead to long-term economic well-being.

By mastering budgeting skills, you can significantly alleviate the stress that often accompanies personal finances, enabling you to allocate your resources more efficiently. A survey by the National Endowment for Financial Education reveals that nearly 71% of students experience anxiety regarding their finances, highlighting the crucial need for educated financial habits.

Understanding credit management is equally vital. Experts stress that financially literate students tend to maintain better credit scores, which can open doors to more favorable loan terms in the future.

Moreover, gaining clarity on student loans can demystify repayment plans, empowering you to tackle your financial obligations with confidence and ease.

Consequences of a Lack of Financial Literacy

The consequences of lacking financial literacy can be severe. It may lead to questionable financial decisions, resulting in debt accumulation, falling victim to financial scams, or even facing bankruptcy.

For instance, individuals can easily get caught by high-interest payday loans due to a misunderstanding of credit options, ultimately trapping themselves in a cycle of debt. Others may be lured into investment schemes promising quick returns, unaware they are engaging with fraudulent entities.

A lack of basic budgeting skills leads to overspending on unnecessary items, depleting savings and compromising financial security.

Real-world scenarios show that when individuals remain uninformed about managing their finances, the repercussions can be devastating not just for their economic well-being but also for their peace of mind.

Teaching Financial Literacy to Students

Teaching financial literacy to students is invaluable. It equips them with essential skills to manage their finances adeptly.

This essential knowledge opens the door to a secure financial future and enhances their potential for greater economic mobility.

Effective Strategies and Resources

Effective strategies for teaching financial literacy involve using budgeting apps, interactive workshops, and real-life simulations that actively engage students in the learning process.

Incorporating technology elevates the educational experience. For example, digital budgeting apps like Mint or YNAB (You Need A Budget) empower students to track expenses in real time.

Explore platforms like Khan Academy for free personal finance courses, making valuable information accessible to everyone.

Games and apps such as Financial Football provide a fun way to reinforce concepts through competition. Workshops featuring guest speakers from local banks or credit unions offer real-world insights, while community partnerships enhance resource availability and ensure practical knowledge that students can apply beyond the classroom.

Real-World Applications of Financial Literacy for Students

The real-world applications of financial literacy for students are extensive. These skills equip them to budget effectively, save diligently, and invest wisely for their future well-being.

By mastering these concepts, students can navigate their financial journeys with confidence and foresight, laying a solid foundation for a prosperous future.

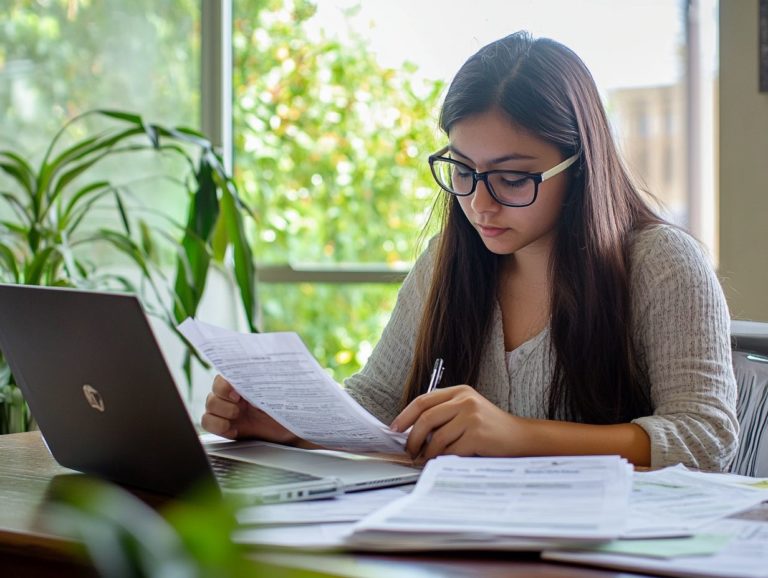

Preparing for College and Beyond

Preparing for college and beyond requires building a solid foundation in financial literacy. Understanding student loans, honing budgeting skills, and recognizing the importance of saving for emergencies are crucial.

As students embark on this life transition, mastering financial concepts is essential for fostering independence and paving the way for economic opportunity.

Understanding how interest rates extra money paid back on a loan affect long-term debt is key. Creating and sticking to a monthly budget that accommodates both academic expenses and personal needs is also necessary.

Developing the habit of setting aside funds for unexpected situations provides a safety net, enabling students to navigate early adulthood confidently. Ultimately, these skills empower them to make informed financial decisions that align with their goals, ensuring they thrive in the years to come.

Building Financial Literacy Skills

Building financial literacy skills is crucial for achieving confidence in managing money effectively.

This foundation enhances the ability to navigate financial decisions and plays a significant role in accumulating wealth and ensuring long-term financial security.

Practical Tips and Exercises

Enhance your understanding of money with practical tips. Start by creating a personal budget and setting clear financial goals.

Explore interactive online courses to learn about investments and savings strategies. These courses offer great insights into managing your money.

Participate in workshops or seminars for hands-on experience. This allows you to apply your knowledge in real-life situations.

Regularly assess your finances with self-reflection tools. This helps you identify your strengths and find areas for improvement.

Continuously educate yourself to boost your confidence in money management. Stay updated with the changing financial landscape to keep your skills relevant.