Understanding the Differences in Student Aid

Navigating the world of student aid can feel overwhelming, yet it s essential for securing the funding needed for your education.

This overview dives into the exciting world of student aid and explores how it can change your life. We will define what student aid is and discuss the various types available grants, scholarships, loans, and work-study programs.

You’ll learn how to compare and select the best options tailored to your unique needs. Prepare to empower your educational journey with the right financial support!

Contents

Key Takeaways:

Understanding the differences in student aid can help you make informed decisions about your education financing options.

Grants and scholarships are free money that do not need to be paid back, while loans require repayment with interest.

Eligibility for student aid depends on various factors such as how much money you need, academic performance, and the program of study.

Overview of Student Aid

Understanding student aid is crucial for financing your education. It includes funding options like federal loans, private loans, scholarships, and understanding the financial aid award letter.

These financial resources aim to ease the burden of college expenses and make higher education attainable for students from varied backgrounds. They ensure that financial challenges do not obstruct academic ambitions.

This section provides a thorough overview of the student aid options available to you, detailing eligibility criteria and the application process through the FAFSA form.

What is Student Aid?

Student aid encompasses the financial assistance you can receive to help cover various costs associated with your education, such as tuition, fees, and living expenses. This support can significantly reduce your financial burden and make higher education much more accessible.

There are various types of aid available, including scholarships, grants, and loans, each tailored to meet your specific financial needs.

- Scholarships and grants, which can be based on merit or need, are particularly attractive because they don t require repayment.

- On the other hand, you might find yourself turning to federal and private loans to fill any remaining funding gaps.

Federal loans typically offer lower interest rates and more favorable repayment terms, making them a smart choice. Private loans, while sometimes providing larger amounts, often come with variable interest rates and less flexible repayment options.

Understanding these differences is essential for making informed financial decisions throughout your educational journey.

Types of Student Aid

You have access to various types of student aid, each tailored to help you finance your education according to your unique needs and circumstances.

These options include:

- Grants

- Scholarships

- Loans

- Work-study programs

All are designed to support you on your educational journey.

Grants

Grants represent a valuable form of financial aid that requires no repayment. This makes them an appealing choice as you pursue higher education.

These financial resources can significantly lighten the load of college expenses, allowing you to concentrate on your studies instead of succumbing to the stress of mounting debt.

You ll find various types of grants available, including federal options such as the Federal Pell Grant, aimed at undergraduates who show exceptional financial need, and the Federal Supplemental Educational Opportunity Grant (FSEOG), tailored for those facing the greatest financial hardships.

Eligibility for these grants often hinges on factors such as your family’s income, enrollment status, and the results of the Free Application for Federal Student Aid (FAFSA). By familiarizing yourself with these grant options, you can uncover pathways that may transform your college dreams into reality without the burden of future financial obligations.

Scholarships

Scholarships represent a highly competitive way to get financial help, awarded to students based on a range of criteria, including academic merit, extracurricular engagement, and unique talents.

These valuable forms of support can significantly lighten the financial load associated with pursuing higher education. The most common types include:

- Merit-based scholarships, which recognize individuals for their academic achievements or exceptional performance in sports or the arts.

- Need-based awards, which focus on the financial circumstances of the applicants.

Eligibility criteria can vary widely. Merit-based scholarships typically cater to academically high-achieving students. Need-based awards require showing financial need with documents such as the Free Application for Federal Student Aid (FAFSA).

To secure these scholarships, tap into a variety of resources. High school counselors, online scholarship databases, and local community organizations can help you uncover opportunities that align perfectly with your qualifications and aspirations.

Loans

Loans serve as a prevalent way to finance your education, enabling you to borrow funds that you will need to repay with interest over time.

As you explore your funding options, you might find yourself deliberating the nuances between federal loans and private loans, each presenting its own set of unique features.

Federal loans often come with the advantage of interest rates that stay the same throughout the loan period and flexible repayment plans, including options like income-driven repayment that tailor your payments based on your income.

On the other hand, private loans may offer variable interest rates, with eligibility commonly dependent on your credit score, leading to more rigorous credit checks.

Grasping the distinctions between these two types of loans, particularly regarding repayment terms and borrower protections, can significantly influence the long-term financial implications of your educational investment.

Work-Study Programs

Work-study programs present you with a remarkable opportunity to earn money while you attend school, helping to alleviate those college expenses through part-time employment. Federal and state governments fund these programs, along with participating colleges and universities, which allocate funds based on their specific budgets and financial aid strategies.

As a participant, you can expect a diverse range of job opportunities, from administrative roles in campus offices to research assistant positions. Not only do these roles provide financial rewards, but they also grant you valuable experience in your field of study.

Work-study positions play a crucial role in managing your overall financial aid package, as your earnings are factored in when determining eligibility for additional support. To qualify for this advantageous option, you need to meet certain criteria, including demonstrating financial need.

You also need to complete the FAFSA (Free Application for Federal Student Aid) form, which opens the door to federal financial aid, including work-study eligibility. Don t miss out on this chance to make the most of your academic journey while securing some financial support along the way.

Eligibility for Student Aid

Your eligibility for student aid hinges on several key factors, including your financial need, academic performance, and the timely completion of the FAFSA form. This form serves as a comprehensive assessment of your financial situation, helping to determine the support you qualify for.

Factors That Affect Eligibility

Several factors will influence your eligibility for financial aid, including your income level, family size, and the specific requirements of grants and scholarships. These criteria can vary significantly based on the type of financial aid you re pursuing.

For example, federal loans often require you to demonstrate financial need, while state grants might prioritize residents who meet specific local income thresholds. Scholarships, on the other hand, may evaluate your academic performance or extracurricular involvement in addition to your financial circumstances.

Central to this entire process is the FAFSA form, which collects essential information from you and your family to assess your financial situation and match it with the available aid options. By accurately completing the FAFSA, you unlock access to various funding sources, paving the way for a more seamless journey toward your educational goals.

Applying for Student Aid

Applying for student aid requires you to complete essential documentation and meet specific deadlines.

The FAFSA form serves as the primary application for federal financial aid. It s crucial to navigate this process with diligence and attention to detail.

Required Documents and Deadlines

To apply for student aid, you must submit various documents by specific deadlines. This ensures you receive the financial assistance you need.

Start by gathering essential documents, such as:

- Your Social Security number

- Tax returns from the previous year

- Bank statements detailing your assets

Each of these items is crucial in determining your eligibility and the amount of aid available to you.

Don’t miss those crucial deadlines! They can make or break your financial aid application.

To navigate this paperwork efficiently, create a checklist and set reminders for submission dates. Grouping your documents by type can also make your application process smoother.

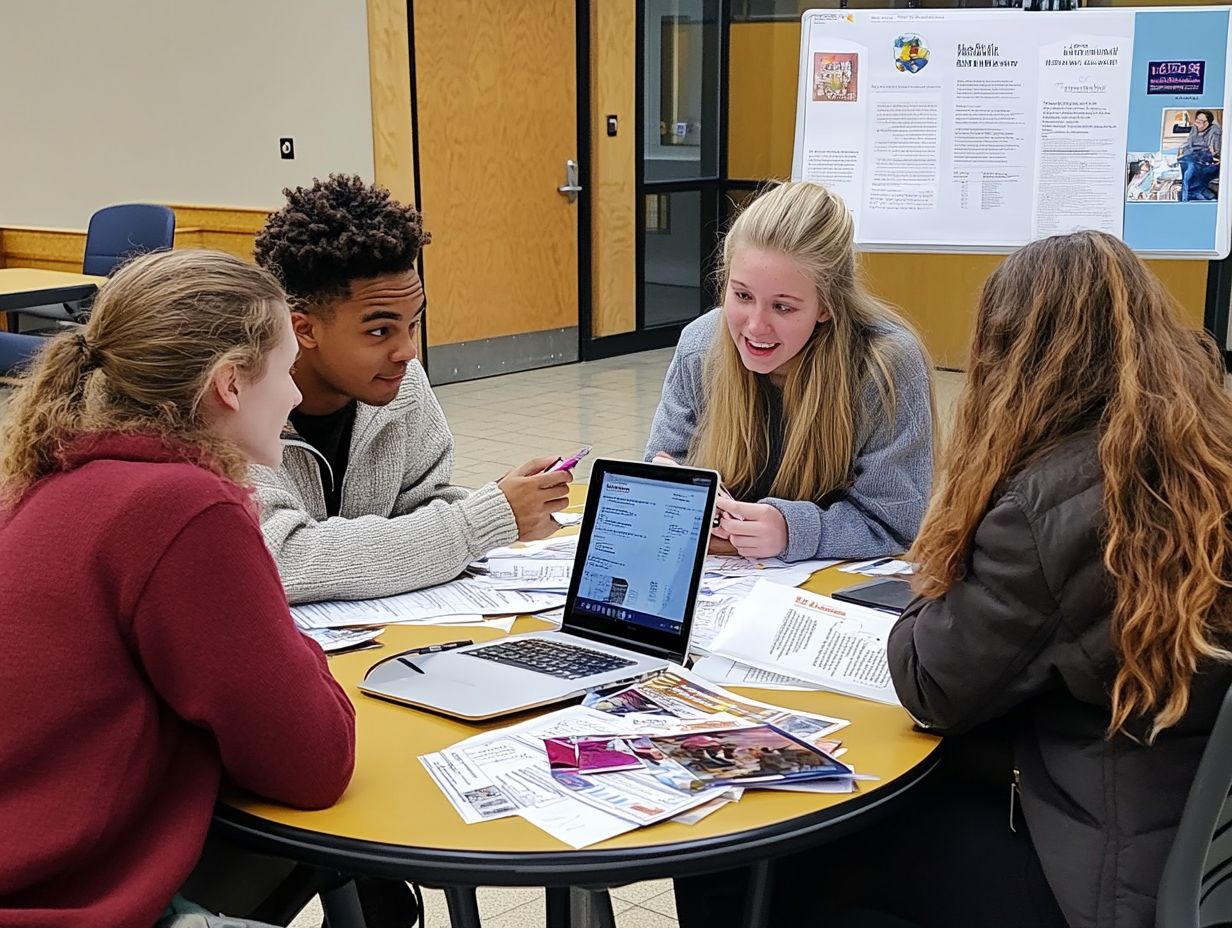

Comparing and Choosing Student Aid Options

When financing your education, it s essential to compare and evaluate various student aid options. This careful consideration helps you make informed financial decisions that align with your unique needs.

Factors to Consider

Several factors play a vital role in selecting the most suitable student aid options. Assess your financial needs, as this directly influences the type of aid you should pursue.

Interest rates on loans can dramatically affect your future repayments. It’s essential to compare offers and understand the long-term financial implications.

Also, consider the benefits of scholarships, which don t require repayment. This can pave a clearer, debt-free path for you after graduation.

By evaluating these aspects, you can make informed choices tailored to your situation.

Resources for Comparing Options

Numerous resources can help you evaluate your options for student aid, ensuring informed financial decisions.

These resources include comprehensive government websites with detailed insights into various aid programs. You can also find tools that help you estimate how much money you may need.

Counseling services are also available to provide personalized guidance and address any questions about the application process or eligibility criteria.

By leveraging these tools, you can effectively navigate your choices and gain a clearer understanding of your financial landscape.

Frequently Asked Questions

What is student aid?

Student aid helps cover education costs. It includes grants, scholarships, loans, and work-study programs.

What are the differences between grants and loans?

Grants are typically need-based and do not need to be repaid. Loans require repayment with interest.

What is the difference between scholarships and grants?

Scholarships are often merit-based, awarded based on academic achievements or talents. Grants are typically need-based.

How do I determine if I am eligible for student aid?

To determine your eligibility for student aid, complete the Free Application for Federal Student Aid (FAFSA). This form assesses your financial need and eligibility for federal and state aid programs.

Take the first step towards your education fill out your FAFSA today!

What is the difference between federal and state aid?

Federal aid comes from the federal government. In contrast, state aid is provided by state governments. Each type has unique eligibility requirements.

They can be offered as grants, scholarships, or loans to support students.

What is work-study and how is it different from other types of aid?

Work-study is financial aid that lets students work part-time while they attend school. This program helps students earn money to cover education costs.

Work-study differs from other aid options because students actively earn the funds instead of receiving them outright.